Portfolio Management – How CVCs add value post investment

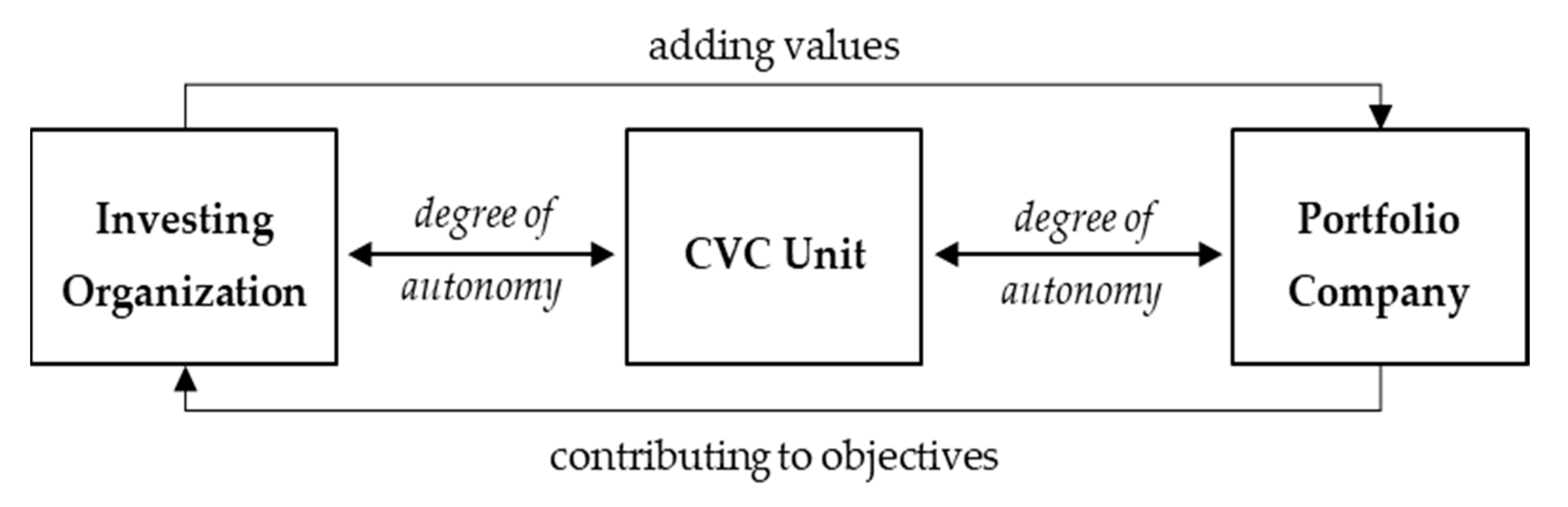

Corporate venture capital (CVC) firms are becoming increasingly popular as an investment vehicle for corporations looking to invest in promising startups. These firms can provide capital, industry expertise, and strategic guidance to their portfolio companies, helping them to grow and succeed in their respective industries. However, the value that CVC firms can bring to their portfolio companies doesn't end with the initial investment. In this article, we will discuss how CVC firms can continue to add value to their portfolio companies post-investment. Providing industry expertise and connections One of the biggest advantages that CVC firms have over traditional venture capital…